If you are currently renting, your rent may be rising! And with interest rates at historically low levels, you may be thinking that 2021 is the year to buy your first home! But then you talk to friends who are also trying to buy their first home and they tell you about all the offers they have written – and none have been accepted!

Yes, it is a tough real estate market for first time home buyers! Multiple offers on homes are not uncommon, prices are rising and it is hard to compete with someone who is willing to pay the moon in cash!

But first time homebuyers are buying homes even in today’s real estate market of extremely low inventory! However, you need to take some steps to make sure you are competitive when making an offer!

As a Realtor who specializes in first time homebuyers, there are some things you can do to make sure that you can buy your first home in 2021!

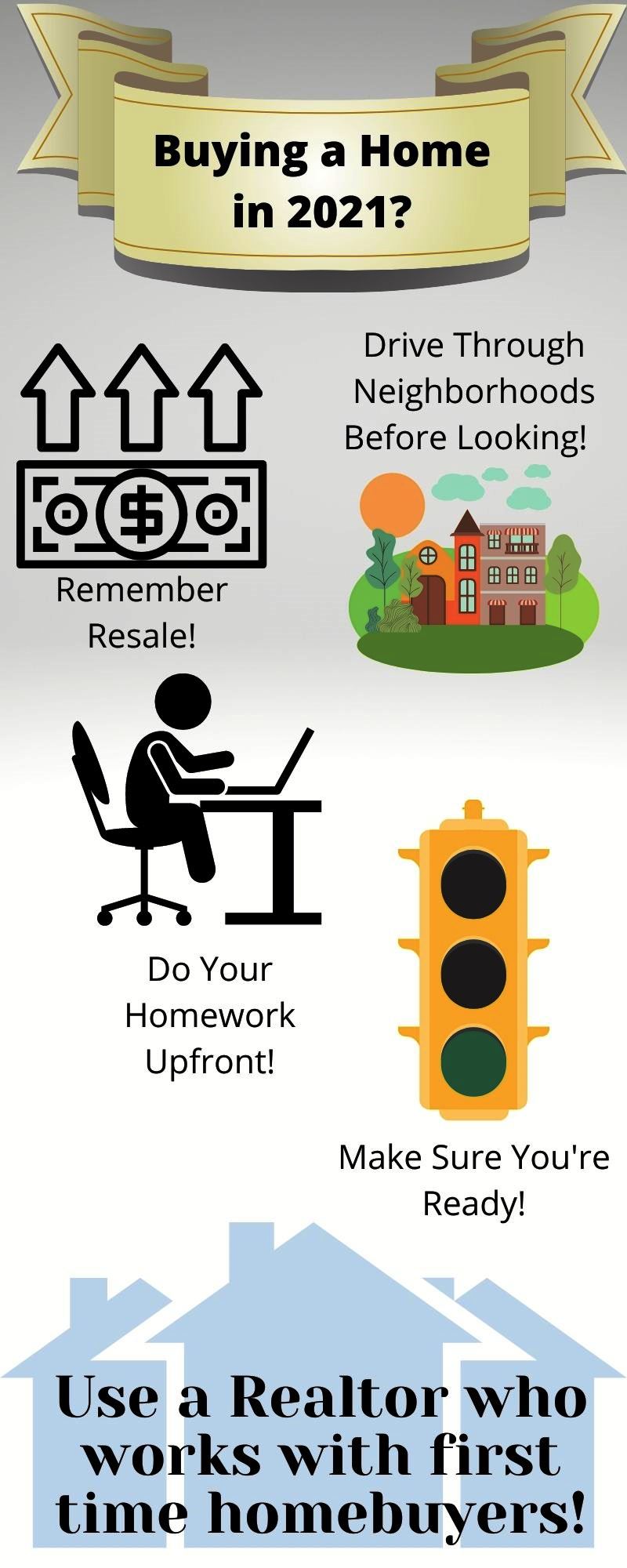

FIRST – REMEMBER RESALE!!!

This is always important to remember, but even more so now! This is your first home and you will probably not be in it forever! This market will eventually cool down, and, at some point, you will sell your home and move into another home! So keep in mind the resale potential of your home! That also means keeping in mind things you can do after your purchase to add value to the house! If the home does not have a deck on it, this is something that can be added after closing! You may not like carpet, but changing the flooring to luxury vinyl tile or hardwood will definitely add value! A dated kitchen can easily be modernized over time! The home may not be your perfect home, but it can definitely become perfect over time!

SECOND – DRIVE THROUGH NEIGHBORHOODS BEFORE LOOKING!!!

When homes come on the market you will need to move fast on it! Remember you are not just buying a home, you are also buying a neighborhood! So before you actually begin looking at homes, drive through neighborhoods and make a note of the neighborhoods you like – and the ones you don’t like. That way, when something comes on the market in one of the neighborhoods, you are ready to jump on it, without regretting any hasty decisions!

THIRD – DO YOUR HOMEWORK UPFRONT!!!

In this market where you need to move quickly when a house comes on the market, you need to be ready to jump! And you need to be in the absolute strongest position possible to feel comfortable jumping quickly! So, talk to your lender about financing options – FHA, VHDA, VA, Conventional loans – grant funds and gift funds – submitting documentation to the underwriter before looking for a home! Find out what your maximum loan amount is that you qualify for – and what payment you are comfortable making each month! Think about what contingencies you are willing to give up and which ones you aren’t! Read through the contract paperwork you will be signing to make sure you are comfortable with it! If the neighborhood has an HOA, try to find out BEFORE you write an offer if you can live with the rules & regulations of the HOA! Decide if you want to take a home inspector along with you to look at houses you are seriously considering BEFORE you write an offer! Try to save extra money now so you can have a larger downpayment - theVirginia First Time Homebuyer Savings Plan could work for you! Anything you can do before you start looking for a home will help to make you a stronger buyer when you do finally find the house to make an offer on!

FOURTH – MAKE SURE YOU ARE REALLY READY TO BUY!!!

Buying a house because someone told you to buy a house, or that paying rent was a waste of money, or the interest rates are low is not the right reason to buy a house! You need to make sure you are ready to take on home ownership. If you are, then paying your mortgage each month rather than rent is a bonus because it builds your equity, not your landlord’s equity! Having a low interest rate on your mortgage is a bonus because it means your payment is going to be lower than your rent! But you need to be ready to take on the challenge of finding a home, writing offers (because you may end up writing several before one is accepted) – but if the time is right for you to buy your first home, it will definitely be worth it!

FINALLY – MAKE SURE YOU USE A REALTOR WHO SPECIALIZES IN FIRST TIME HOMEBUYERS!!!

Buying your first home can be exciting, but it can also be stressful as there are lots of twists & turns on the road to homeownership. A Realtor who works with first time homebuyers will be able to understand what you are going through and will be able to help you navigate the challenges. They will also have resources and contacts to help make the process as smooth as possible!

Inventory levels remain very low, homes are flying off the market, but being prepared before you begin your home search will help to relieve some of the stress of the 2021 real estate market!

Have a question? Thinking of buying your first home? Feel free to contact me – I am happy to help!